This higher estimate is an effort to prevent another shortage. If you had too much money in the account, your mortgage payment may go down and you’ll receive a refund each year. If your mortgage is escrowed, then your monthly payment is split into three parts.

What are Escrow Account Costs?

Learn more about what mortgage points are and determine whether “buying points” is a good option for you. We believe everyone should be able to make financial decisions with confidence. The use of this website means that you accept the confidentiality regulations and the conditions of service. If you feel ready to begin the home buying process, get approved with Rocket Mortgage today. Below, you can find some frequently asked questions to help you better understand escrow and the process.

How To Get Out Of A Mortgage

Chase’s DreaMaker home loan allows buyers to put down as little as 3% of the home’s price. If you’d given your deposit directly to the seller, there’s a chance they wouldn’t return your deposit. But since the deposit is being held by a third party, you can be confident it will be returned according to your agreement. Omega Lending Group is a local mortgage lender based in Royal Oak, MI serving Michigan home buyers and home owners. At Omega we believe that obtaining a mortgage or refinancing a home loan should be a smooth and easy process driven by real people, not algorithms or chat bots.

Estás ingresando al nuevo sitio web de U.S. Bank en español.

Once the home loan has been paid off, the loan servicer has 30 days to send you a refund for what’s left in your escrow account. Because the escrow company is working for both the buyer and the seller in the real estate transaction, the fee for their services is usually split evenly between the two parties. When you’re buying a home, escrow may be managed by a mortgage servicing company or agent. The escrow agent or company is sometimes the same as the title company. Yes, if the amount of money you make varies a lot from month to month, you might benefit from putting money for taxes and insurance aside on your own. This way, you could set aside more during good months and vice versa.

These items (money or property) can’t be released until all conditions are met between both of the parties. The escrow company not only manages the buyer’s deposit, but they may also be responsible for holding the deed and other documents related to the sale of the home. If you’re building a new home, money may remain in escrow until you’ve signed off on all the work. Once the conditions are met, the money will be released to the right party.

- We’ll keep you updated and let you know about any changes to these amounts when we review your escrow account each year.

- In other places, escrow fees might be paid solely by either the buyer or the seller.

- The only exception is if you change insurance providers or policies.

- An escrow account is one you fund each month, and we use to pay for these items on your behalf when they’re due.

What is an escrow account?

To set up your mortgage escrow account, the state of oregon lender will calculate your annual tax and insurance payments, divide the amount by 12 and add the result to your monthly mortgage statement. Each month, the lender deposits the escrow portion of your mortgage payment into the account and pays your insurance premiums and real estate taxes when they are due. Your lender may require an “escrow cushion,” as allowed by state law, to cover unanticipated costs, such as a tax increase.

You will pay no more than one-sixth of the total estimated yearly escrow at closing, which will allow the lender or loan servicer to have a couple of months’ worth of payments in advance. The yearly and monthly costs for your escrow account will be estimated during the mortgage application process and finalized at closing. A mortgage escrow account is an arrangement with your mortgage lender to ensure payment of your property tax bill, homeowners insurance and, if needed, private mortgage insurance (PMI). On most conventional mortgages, lenders require PMI if your down payment is less than 20%.

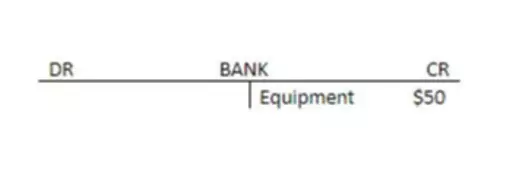

This amount is typically added to your mortgage, so you just have one simple payment to track. If the escrow balance is more than $50 over the required amount, you’ll get a check; under $50 and you might get a refund or a credit will be applied to your account. If there’s not sales tax deduction calculator enough in your escrow account to cover the new costs, you might be able to pay the additional amount right away or spread payments over the next 12 months. Mortgage escrow accounts should not be confused with the term escrow used during the home purchase process. You’ll pay earnest money when making a purchase offer to protect the seller in case the purchase doesn’t go through.

The servicer is allowed to collect slightly more money as a financial cushion to cover unanticipated increases in taxes and insurance. As stated before, an escrow account is funded through your monthly mortgage payment, making your monthly bill higher than it would be without escrow. But this also means that you don’t have to pay your taxes or insurance in a lump sum when they are due, so this is hardly a disadvantage when you think about it. Since taxes and insurance are typically paid annually or semiannually, they are usually held in escrow by the lender or another company servicing the loan. You pay into your escrow balance each month with your regular payment, and your taxes and insurance are automatically paid from that account when they’re due. The escrow balance indicates how much money is currently in your escrow account to cover upcoming taxes and insurance payments.

Loans guaranteed by the Federal Housing Administration (FHA) and Veterans Affairs (VA) also require that you have an escrow account for these expenses. An escrow account is sometimes required, and sometimes it’s not. It depends on the type of loan you get, as well as your financial profile. An escrow account is funded each month as part of your total monthly payment.

An escrow agreement is the terms and conditions in a contract between the parties involved and the responsibilities they hold. The escrow agreement will usually involve an independent third party, referred to as an escrow agent. An escrow account is key to protecting your deposit during a home sale.

The answer to this question depends on whether or not you are disciplined about your finances and able to set aside the funds needed for property taxes and insurance payments. If you are disciplined at saving, you may prefer to control the process since tax payments usually are due only once or twice a year. We get this number from your loan closing documents, local property tax office and insurance company. Your escrow balance is the amount of money that is held for you in your escrow account (also called an impound account in some areas of the country).

Your mortgage servicer pays these obligations out of your escrow account on your behalf, and reviews the amounts paid periodically to minimize the chances of a shortfall. The third part of your payment goes toward your escrow balance. In many mortgages, funds are held in escrow to pay property taxes and homeowners insurance.

In either of those cases, your servicer will recalibrate your monthly payment for the year ahead to match the new estimate of your annual tax and insurance bills. Not all banks require you to escrow money for taxes and insurance. Federal Housing Administration (FHA) loans require an escrow account. This protects the bank’s investment in your property by making sure that the taxes and insurance get paid. Escrow for homebuyers is typically 1% to 3% of the total cost of the property. Mortgage escrow is usually determined by the lender, who estimates your property taxes, insurance payments and other expenses for the next year and divides the total by 12.

Catch up on CNBC Select’s in-depth coverage of credit cards, banking and money, and follow us on TikTok, Facebook, Instagram and Twitter to stay up to date. The only exception is if you change insurance providers or policies. You will need to provide the new policy information to your servicer.